HMRC has lost sight of needing to put customers at the heart of changes to the tax system. In a report published today, the Public Accounts Committee (PAC) warns that with the Making Tax Digital (MTD) programme, aiming to make it easier for people to get their tax right, HMRC is increasing the burdens imposed on some taxpayers. The report also finds that, in seeking further investment in MTD, HMRC has not been open enough about the substantial costs that will be imposed on many taxpayers.

The report finds that the design of MTD has not taken sufficient account of the realities facing business taxpayers and agents. While MTD will substantially benefit HMRC by improving its systems, taxpayers will be asked to spend more and do more to comply. Burdens will be increased with Self Assessment taxpayers asked to pay for third party software and file tax returns quarterly. Many stakeholders, including tax experts and software developers, report that up until 2023 HMRC had ignored their advice on MTD.

The report finds that HMRC excluded a total of over £2bn in upfront transitional costs for customers from its 2022 and ’23 business cases for MTD. Business taxpayers could have to pay more than £1.9bn to comply with new arrangements over the first five years, and HMRC has not said how many and which customers will face the highest transitional costs. The PAC is concerned about how much MTD could cost customers, and calls for full transparency on costs and benefits to the public purse and customers in future.

Unacceptably, with £640m of taxpayer’s money spent on MTD as a whole, many questions remain about how it will work for Self Assessment. HMRC has yet to figure out how to make MTD work for important elements such as how the system will support taxpayers with multiple agents, and how it will work for people who share ownership of property.

Widespread and repeated failures in HMRC’s planning, design and delivery of MTD have led to increased costs and several delays to the programme. HMRC expects introducing MTD for VAT and Self Assessment will now cost £1.3bn, a 400% increase in real terms compared to its original estimate of £222 million in 2016 for all three taxes in the programme. HMRC’s poor track record of repeated delays to MTD, and its lack of conviction in its latest timetable, gives the PAC little confidence that it will deliver the rest of MTD on time.

Chair's comments

Dame Meg Hillier MP, Chair of the Public Accounts Committee, said:

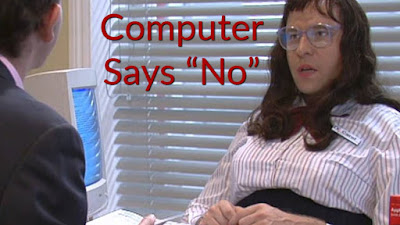

“When reporting on proposals for digitalising the tax system, our Committee should not have to be recommending that HMRC start with what taxpayers need – in an ideal world, one would hope this would simply go without saying. But seven years and £640 million into the Making Tax Digital programme, we are concerned HMRC is also succeeding in making tax difficult.

Imposing significant additional burdens on customers in the middle of a cost of living crisis could not be less welcome. HMRC must now look up from what it is doing and research what services customers would actually find most helpful. We are also concerned at the substantial costs to be imposed on many taxpayers. HMRC’s exclusion of billions of pounds of projected costs when seeking investment for the programme is utterly extraordinary, and future transparency on costs and benefits must be non-negotiable.”

Tax does have to be taxing.

Tax Investigation Insurance

Market leading tax fee protection insurance for businesses, sole traders and individuals. Protect yourself from accountancy fees in the event of an HMRC enquiry.

Having a Solar Protect Tax Investigation Insurance policy at your disposal means that should you be one of the many 1000's of businesses or individuals that are selected by HMRC each year to look into your tax affairs your own accountant (your tax return agent) can get on and defend you robustly.

You have the peace of mind knowing that your accountant's (your tax return agent) fees will be paid by the insurance without any Excess for you to find.

Tax Investigation Insurance is an insurance policy that will fully reimburse your accountant's (your tax return agent) fees up to £100,000 if you are subject to enquiry by or dispute with HMRC.

A Solar Protect policy will enable your accountant (your tax return agent) to:

- Deal with any correspondence from HMRC

- Attend any meeting with HMRC

- Appeal to the First-tier Tribunal or Upper Tribunal

- Having the security of knowing that fees will be met in full will enable your Accountant (your tax return agent) to defend your position robustly

Please click here for details.

HMRC Is Shite (www.hmrcisshite.com), also available via the domain www.hmrconline.com, is brought to you by www.kenfrost.com "The Living Brand"