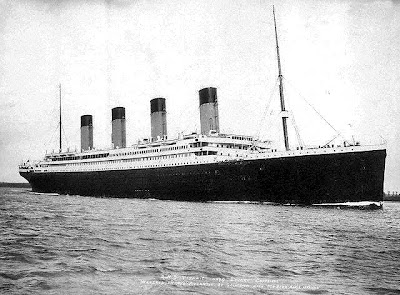

As loyal readers know, HMRC's flagship RTI is due to set sail this April.

Unfortunately, many people are as yet unaware that this mighty vessel is soon to set sail and have yet to organise their affairs accordingly.

As such HMRC is writing to all employers to give them guidance on what needs to be done, as HMRC has realised that people are "blissfully" unaware and unprepared for RTI (Real Time Information).

HMRC has its work cut out for itself, because a survey of 126 SMEs in January showed that 96% of companies or their clients had no knowledge of the changes, or those who do, had no idea of its implementation.

Unfortunately, many people are as yet unaware that this mighty vessel is soon to set sail and have yet to organise their affairs accordingly.

As such HMRC is writing to all employers to give them guidance on what needs to be done, as HMRC has realised that people are "blissfully" unaware and unprepared for RTI (Real Time Information).

HMRC has its work cut out for itself, because a survey of 126 SMEs in January showed that 96% of companies or their clients had no knowledge of the changes, or those who do, had no idea of its implementation.

Rather alarmingly for HMRC, aside from the real world not being aware of or ready for RTI, it seems that HMRC are not ready for it either. As per PAC in December 2012:

"HMRC did not convince us that it will manage the potential increase in its workload or that it had fully considered the impact on taxpayers."However, Lin Homer is optimistic and is quoted by Economia:

“PAYE directly affects every employee in the country and that is why it is vital that it reflects, on time and accurately, the tax circumstances of the millions of employees who depend on the system to get their tax right.Anyhoo, here are some HMRC links that are meant to help you prepare for RTI.

RTI delivers on all fronts.

Business costs will be cut by £300m a year, employees will be taxed more accurately and fraud and error in the tax credit system will be reduced by hundreds of millions of pounds every year.

Employers can find all the information they need on our website about moving onto the new system, and small businesses can download our free software to help them get ready. Businesses should act now to be ready for April, when RTI comes in.”

God bless all who sail in her!

Tax does have to be taxing.

Professional Cover Against the Threat of Costly TAX and VAT Investigations

Insurance to protect you against the cost of enquiry or dispute with HMRC is available from several sources including Solar Tax Investigation Insurance.

Ken Frost has negotiated a 10% discount on any polices that may suit your needs.

However, neither Ken Frost nor HMRCISSHITE either endorses or recommends their services.

What is Solar Tax Investigation Insurance?

Solar Tax Investigation Insurance is a tax-fee protection service that will pay up to £75,000 towards your accountant's fees in the event of an HM Revenue & Customs full enquiry or dispute.

To find out more, please use this link Solar Tax Investigation Insurance

Tax Investigation for Dummies, by Nick Morgan, provides a good and easy to read guide for anyone caught up in an HMRC tax investigation. A must read for any Self Assessment taxpayer.

Click the link to read about: Tax Investigation for Dummies

HMRC Is Shite (www.hmrcisshite.com), also available via the domain www.hmrconline.com, is brought to you by www.kenfrost.com "The Living Brand"

No comments:

Post a Comment