I am advised that the HMRC online filing system has crashed today.

I received the following note from a fellow professional:

"

Just tried to log in to check a clients self assessment account – Service is unavailable – at noon on January 31st!!"Well done lads!

They wonder why people don't have any faith in their IT system!

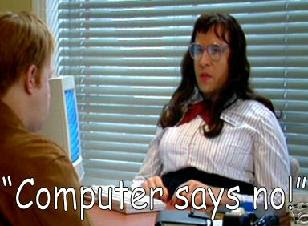

UpdateSeemingly it's the taxpayers' fault for leaving it so late to file their returns!

That at least is the view of the HMRC "helpdesk" (see below).

Here is what the BBC have to say about it:

HM Revenue and Customs (HMRC) has confirmed that its self assessment website is temporarily unavailable.

Tax payers have until midnight on Thursday to file their income tax returns, and pay any tax due, or they will have to pay a fine plus interest.

HMRC said it apologised "for any inconvenience caused", and added it was working to restore the service "as soon as possible".

More than 150,000 people filed their tax return on 31 January last year.

An HMRC spokesman confirmed the service had gone down "at some point on Thursday morning", although he could not say what had caused the problem.

"

The self assessment online system is temporarily unavailable", he said.

"

We apologise for any inconvenience caused, and are working to restore the service as soon as possible."

The BBC has been deluged with complaints from taxpayers who have found themselves unable to log in to the system.

Edward Buxton from Nuneaton has spent the morning trying to file returns on behalf of himself and his wife.

"

I first logged in at about 9.00 this morning, after the school run - I must have kept pressing refresh for about an hour; then I gave up," he said.

"

I have been trying on and off since. Once I got a message from HMRC saying that they are aware of the problem. but most of the time the message just says something along the lines of 'the server has no idea what the page is you are trying to access'.

"

That doesn't give you great confidence," he added.

Chris Kirby is an accountant based in Redcar in North Yorkshire.

He is trying to file returns on behalf of six clients.

He said the problem first arose at about 4pm on Wednesday afternoon, after which the website "pretty much crashed".

He has not managed to get onto the system since. He said that when he first contacted the helpline, they denied anything was wrong.

Eventually staff told him the problem was down to "too many people trying to log on".

"

One person on the helpline was quite rude, and said 'It's your own fault for leaving it to the last minute'," he said.

But it is not uncommon for clients to find they cannot submit their information until just before the deadline, he said, and he believed HMRC should be able to cope.

"

They should have had not just sufficient capacity but spare capacity to deal with the peaks they should have known they were likely to get today," he said.

His clients now faced the automatic £100 fine for non-submission which he would then have to appeal on their behalf.

"

Really, it's just not good enough for a public body," he added.

Chas Roy-Chowdhury, head of tax at the Association of Chartered Certified Accountants (ACCA), said HMRC should consider pushing back the cut off point.

"

If the Revenue's IT systems have crashed, then they need to extend the deadline. They need to be pragmatic."

If the problem continued for a few hours, he said the deadline should be pushed to Monday.

He said this would encourage people to use the online system in future years.

HMRC Is Shite (

www.hmrcisshite.com) is brought to you by

www.kenfrost.com "

The Living Brand"